Prepare for the Renters Rights Bill: Landlord Checklist

The Renters Rights Bill is set to bring significant changes to the private rental sector in England – and if you’re a landlord, now is the time to act. With Section 21 notices on their way out and a wave of new legislation approaching, aligning your property portfolio with the upcoming changes is critical.

At Michael Tuck Estate & Letting Agents, we’re here to help you adapt with confidence. Below, we’ve outlined a practical, step-by-step checklist to ensure you’re ready for what’s coming in 2025 and beyond.

Renters Rights Bill: What’s Changing?

Before diving into the checklist, here’s a quick refresher on the key proposals in the Renters Rights Bill:

-

Abolition of Section 21 “no fault” evictions

-

A single system of periodic tenancies

-

Stronger grounds for repossession under Section 8

-

New standards for housing quality and property conditions

-

Introduction of a new Property Ombudsman for all landlords

These changes aim to create a fairer rental market for tenants while raising expectations for landlords.

Checklist: How to Prepare Your Property Portfolio

1. Review All Tenancy Agreements

Ensure your contracts are legally up to date and reflect the shift to periodic tenancies. Speak to a lettings expert to future-proof your agreements.

Tip: Remove any references to fixed terms or automatic renewal clauses that may become obsolete.

2. Evaluate Section 21 Usage

If you currently rely on Section 21 notices for managing tenant turnover, start planning alternative strategies.

Tip: Familiarise yourself with the revised Section 8 grounds, especially concerning rent arrears, antisocial behaviour, or moving back into the property.

3. Inspect Property Standards

The Decent Homes Standard will soon apply to the private rental sector. Start conducting pre-emptive inspections to identify potential issues.

Tip: Prioritise damp, mould, and energy efficiency upgrades to avoid future penalties.

4. Understand the Ombudsman Scheme

All landlords will need to register with a new ombudsman. Prepare by reviewing your complaint handling process and documentation procedures.

Tip: Keep a written record of all tenant communications and maintenance logs.

5. Build in Flexibility

With fixed-term tenancies likely to become a thing of the past, consider how this will affect your rental income, void periods, and long-term planning.

Tip: Budget for more frequent changes in occupancy and maintain strong relationships with tenants to encourage longer stays.

6. Seek Expert Advice

Now more than ever, landlords should seek professional guidance to stay compliant and protect their investments.

Tip: Partnering with an experienced letting agent like Michael Tuck ensures your rental strategy is proactive—not reactive.

What Are the Risks of Not Preparing?

-

Legal non-compliance and possible fines

-

Increased void periods due to outdated processes

-

Tenant disputes and potential damage to reputation

-

Difficulty regaining possession of your property

Don’t get caught out. Proactive planning will keep you in control when the reforms take effect.

Future-Proof Your Rental Strategy with Michael Tuck

At Michael Tuck, we help landlords across Gloucester and the surrounding areas stay ahead of market changes. Whether you own a single property or a diverse portfolio, our local lettings experts can provide the legal insight, market knowledge, and property management support you need to thrive post-reform.

Speak to our team today to review your contracts, assess risk areas, and ensure you’re ready for the Renters Rights Bill.

Should You Still Invest in Buy-to-Let in 2025?

As we move through 2025, the UK property market continues to evolve—and so does the landscape for buy-to-let investors. With the introduction of new legislation, changes in rental demand, and shifts in mortgage rates, many landlords are asking: is buy-to-let still worth it in 2025?

At Michael Tuck Estate & Letting Agents, we’ve been guiding property investors in Gloucester and beyond for over 40 years. Here’s our updated take on whether buy-to-let investment in 2025 still makes sense—and what you should consider before committing your capital.

Is Buy-to-Let Still Profitable in 2025?

Despite tighter regulations and fluctuating mortgage rates, buy-to-let remains a potentially profitable investment strategy—especially in areas with strong rental demand like Gloucester, Cheltenham, and other parts of Gloucestershire.

Rental yields in 2025 remain competitive, particularly for landlords who invest wisely and manage their properties efficiently. With house prices stabilising and tenant demand high due to affordability issues for first-time buyers, the right property can still deliver a strong return on investment.

However, success in today’s market requires more than just purchasing and letting a property. You’ll need to stay ahead of legislative changes, manage costs carefully, and adapt your approach to maximise returns.

What Are the Risks of Buy-to-Let in 2025?

Buy-to-let is not without its challenges in 2025. Here’s what investors should be aware of:

-

Higher borrowing costs: Although inflation is beginning to ease, interest rates remain elevated compared to pre-2022 levels. This impacts mortgage affordability for landlords.

-

Tax changes: Mortgage interest relief has been fully phased out, and capital gains tax thresholds have tightened, affecting profitability when selling.

-

Maintenance and compliance costs: Ongoing maintenance, EPC upgrades, and legal compliance (such as Right to Rent checks) continue to increase outgoings.

-

Void periods: In areas with saturated rental markets or misaligned pricing, landlords may face longer void periods if properties aren’t marketed effectively.

What Does the Renters Rights Bill Mean for Landlords?

The Renters Rights Bill, expected to come into full effect in 2025, represents the most significant shift in the private rental sector in over a decade.

Key changes include:

-

Abolition of Section 21 “no-fault” evictions

-

Introduction of a new single tenancy type (a periodic tenancy)

-

Stronger grounds for possession under Section 8

-

Property ombudsman access for all tenants

-

Requirement for landlords to join a new digital property portal

For landlords, this means more accountability and a need for clearer documentation and tenant communication. While these reforms aim to improve tenant security and property standards, they also demand a more professional approach from landlords.

So, Is Buy-to-Let Worth It in 2025?

The short answer: yes—but only if you’re prepared.

In 2025, buy-to-let can still be a rewarding investment, particularly in thriving rental markets and with the right support. But it’s no longer a passive income solution. Landlords must be strategic, financially aware, and up to date with regulations.

If you’re unsure whether to invest—or how to adapt your portfolio—seeking expert landlord investment advice is more important than ever.

Get Expert Buy-to-Let Advice Today

At Michael Tuck, our experienced team helps new and seasoned landlords navigate the 2025 buy-to-let market with confidence. Whether you’re looking to expand your portfolio or wondering if buy-to-let is still worth it, we offer tailored advice based on local insight and national trends.

Rental Yields Explained: What Landlords Should Look for in 2025

Whether you’re an experienced landlord or exploring your first buy-to-let investment, understanding rental yield is essential in 2025’s property landscape. With mortgage rates, tenant demand, and regional house prices in flux, knowing how to calculate and improve your yield can make all the difference.

What is a good rental yield?

Rental yield is the return you earn from letting out a property, expressed as a percentage of the property’s value. It gives you a quick way to compare potential returns from different properties.

In 2025, a “good” rental yield typically falls between 5% and 8%, depending on the location and property type. Higher yields may indicate stronger returns but can also come with higher management or maintenance risks.

How do I work out rental returns?

There are two ways to calculate yield:

-

Gross rental yield

(Annual rental income ÷ Property purchase price) × 100

For example:

£10,800 annual rent ÷ £200,000 property price = 5.4% gross yield -

Net rental yield

(Annual rental income – costs) ÷ Property purchase price × 100

This accounts for expenses like mortgage payments, insurance, letting agent fees, and maintenance.

Tip: Net yield gives a more accurate picture of actual return, especially important with inflation and cost-of-living pressures affecting landlords in 2025.

What affects rental profit?

Several key factors influence your rental income and profitability:

-

Location – Rental demand is high in university towns, commuter belts, and areas with strong job markets. Gloucester and its surrounding areas continue to offer a strong balance of affordability and demand.

-

Property type – Flats often offer better yields than large detached homes due to lower purchase costs.

-

Tenant demand – Strong demand can mean fewer void periods and potential for rent increases.

-

Running costs – Mortgage interest, insurance, letting fees, and maintenance all eat into profits.

-

Energy efficiency – New EPC requirements may require upgrades, but energy-efficient homes can attract better tenants and higher rent.

Talk to us about maximising your property’s return.

Whether you’re reviewing your current portfolio or considering a new investment, our lettings experts are here to help you make informed, profitable decisions in 2025.

📞 Call us or pop into your local Michael Tuck branch

Spring into Selling: How a Sparkling Clean Home in Gloucester Boosts Your Property Value!

Spring is here, and in Gloucester, that means more than just daffodils blooming – it’s the perfect time to give your home a refresh! At Michael Tuck Estate & Letting Agents, we know a clean, well-maintained home isn’t just about feeling good; it’s about maximising your property’s appeal and value in the competitive Gloucester property market. So, ditch the winter blues and grab your cleaning gear! We’re here to turn your spring cleaning mission into a profitable endeavour.

Decluttering for Maximum Impact in the Gloucester Property Market

- Embrace the One-Year Rule for Selling: When preparing to sell in Gloucester, be even more ruthless. Potential buyers need to envision themselves in the space. Haven’t used it in a year, and it doesn’t add to the home’s appeal? Let it go!

- The Kon Mari Method and Staging: Use the “sparks joy” method, but also consider if items enhance your home’s presentation. A clutter-free, airy space is more attractive to Gloucester homebuyers.

- Room-by-Room Staging Approach: Tackle rooms with the most impact first – living areas and kitchens! These are key selling points in Gloucester homes.

Deep Cleaning Tips to Showcase Your Gloucester Property’s Best Features

- Top-to-Bottom Clean for Showings: Dusting ceiling fans and cobwebs is crucial for a polished look. Buyers notice the details!

- Microfiber Magic for Gloucester Homes: This tool is essential for showcasing your home’s surfaces, especially in kitchens and bathrooms.

- Natural Cleaners for a Fresh Gloucester Home: Natural cleaners create a fresh, inviting atmosphere, appealing to eco-conscious buyers in Gloucester.

- Highlighting Often-Ignored Spots for Property Value: Clean baseboards, window blinds, and oven hoods to demonstrate meticulous care, increasing perceived value in Gloucester’s property market.

Making Spring Cleaning Manageable for Gloucester Home Sellers

- Break Down Cleaning for Busy Gloucester Residents: Dedicate short bursts to cleaning, especially if you’re juggling viewings and work.

- Upbeat Playlists for Gloucester Home Staging: Make cleaning fun! Music helps create a positive vibe for both you and potential buyers.

- Enlist Help for a Quick Gloucester Sale: Get the family involved! A clean home sells faster in Gloucester.

- Reward Yourself After Show-Ready Cleaning: Celebrate your efforts – a clean home is a major asset in Gloucester’s property market.

The Michael Tuck Advantage: How a Clean Home Helps Your Gloucester Sale

- Expert Advice: Michael Tuck Estate & Letting Agents can provide personalized advice on how to present your home for maximum impact in the Gloucester market.

- Professional Photography: We use high-quality photography to showcase your clean, staged home, attracting more buyers.

- Local Market Knowledge: We understand the Gloucester property market and know what buyers are looking for.

Spring cleaning isn’t just about a tidy home; it’s about maximising your property’s potential in Gloucester. Let Michael Tuck Estate & Letting Agents help you turn your clean home into a successful sale!

Buying or Selling Your Home in Gloucester: A Smooth Move with your Local Estate Agents

Gloucester, a city brimming with history and a strong community spirit, is a fantastic place to call home. Whether you’re planning on selling your current property or searching for your dream house, Michael Tuck Estate & Letting Agents are your local estate agents, here to guide you every step of the way. In this blog, we’ll offer valuable insights and tips for both sellers and buyers in our lovely city.

Why Choose Michael Tuck? Over 40 Years of Gloucester Expertise

For over four decades, Michael Tuck Estate & Letting Agents have been a cornerstone of the Gloucester property market. Our deep-rooted local knowledge is unmatched, giving us a unique understanding of the area’s trends, neighbourhoods, and property values. This experience ensures you receive the most accurate and reliable advice, whether you’re buying or selling.

Selling Your House in Gloucester

If you’re thinking about putting your house on the market in Gloucester, it’s vital to grasp the nuances of the local property scene. Michael Tuck Estate & Letting Agents can provide expert advice and support throughout the entire selling process, ensuring a smooth and successful transaction.

Top Tips for Sellers:

- Get a Professional Valuation: Knowing the accurate market value of your property is essential for setting a realistic asking price. Our 40+ years of local experience ensures accurate valuations.

- Prepare Your Property for Sale: A well-presented home is far more likely to attract potential buyers. Consider decluttering, tackling those minor repairs, and boosting your kerb appeal.

- Choose the Right Estate Agent: Partnering with a reputable and experienced estate agent like Michael Tuck, with our long standing history, can make a significant difference to the success of your sale.

- Market Your Property Effectively: Utilise online platforms, social media, and professional photography to showcase your property’s best features.

- Be Prepared to Negotiate: Be open to negotiation and willing to compromise to achieve a mutually agreeable outcome.

Buying a House in Gloucester

Finding your ideal home in Gloucester can be an exciting, albeit sometimes challenging, journey. Michael Tuck Estate & Letting Agents can help you navigate the complexities of the local market and find the perfect property to suit your needs.

Top Tips for Buyers:

- Get a Mortgage Agreement in Principle: This will give you a clear understanding of your budget and make you a more attractive buyer to sellers.

- Define Your Must-Haves: Consider factors such as location, size, amenities, and proximity to schools and transport links. Our local knowledge can help you find the perfect area.

- Work with a Knowledgeable Estate Agent: A skilled agent like us, with our 40+ years of experience, can help you find properties that match your criteria and guide you through the offer and negotiation process.

- Be Prepared to Make an Offer: Once you’ve found a property you love, be prepared to make a competitive offer promptly.

- Conduct Thorough Surveys: Before finalising the purchase, have a professional surveyor inspect the property to identify any potential issues.

Partner with Michael Tuck Estate & Letting Agents

Whether you’re selling or buying a house in Gloucester, Michael Tuck Estate & Letting Agents are your trusted local experts. Our team of experienced professionals, backed by over 40 years of local expertise, has in-depth knowledge of the Gloucester property market and can provide personalised guidance and support throughout your property journey.

Contact us today to find out more about our services and how we can help you achieve your property goals.

Buying or selling a home in Gloucester can be a significant undertaking, but with the right guidance and support, it can be a highly rewarding experience. By following these tips and partnering with Michael Tuck Estate & Letting Agents, with our unparalleled local knowledge and over 40 years of service, you can navigate the Gloucester property market with confidence and achieve your property aspirations.

Navigating the Renters Rights Bill: What Gloucester Tenants Need to Know | Michael Tuck Estate Agents

Navigating the Renters Rights Bill: What Gloucester Tenants Need to Know | Michael Tuck Estate Agents

The landscape of renting in England is set for significant change with the introduction of the Renters Rights Bill. At Michael Tuck Estate & Letting Agents in Gloucester, we understand that staying informed about these changes is crucial for both landlords and tenants. This blog post aims to demystify the bill and explain what it means for renters in our beloved city.

What is the Renters Rights Bill?

The Renters Rights Bill is a proposed piece of legislation designed to overhaul the private rented sector. Its primary goals are to provide greater security for tenants and improve housing standards. Key aspects include:

- Abolition of Section 21 ‘no-fault’ evictions: This is perhaps the most significant change. Currently, landlords can evict tenants without providing a reason using a Section 21 notice. The bill aims to remove this, offering tenants more security in their homes.

- Introduction of stronger grounds for possession: Landlords will still be able to regain possession of their properties, but only under specific, legitimate grounds, such as repeated rent arrears or anti-social behaviour.

- Lifetime deposits: The bill proposes a system where tenants’ deposits can be transferred between properties, reducing the financial burden of moving.

- Establishment of a new Ombudsman: A new private rented sector ombudsman will be created to resolve disputes between tenants and landlords quickly and efficiently.

- Introduction of a property portal: A new online portal will provide tenants with essential information about their rights and landlords’ responsibilities, as well as property information.

What Does This Mean for Renters in Gloucester?

For renters in Gloucester, these changes could bring significant benefits:

- Increased Security: The abolition of Section 21 evictions will provide greater stability and peace of mind. No longer will tenants face the threat of eviction without a valid reason.

- Improved Housing Standards: The focus on stronger grounds for possession and the new ombudsman will encourage landlords to maintain their properties to a higher standard.

- Reduced Financial Burden: Lifetime deposits will alleviate the financial strain of moving, making renting more affordable.

- Greater Transparency: The new property portal will empower tenants with access to crucial information, ensuring they are aware of their rights and landlords’ obligations.

- Faster Dispute Resolution: The new ombudsman will streamline the process of resolving disputes, ensuring that issues are addressed promptly.

Stay Informed with Michael Tuck

The Renters Rights Bill represents a significant shift in the private rented sector. At Michael Tuck Estate & Letting Agents in Gloucester, we are dedicated to keeping you informed and supported throughout these changes.

If you have any questions about the Renters Rights Bill or are looking for rental properties in Gloucester, please contact Michael Tuck Estate & Letting Agents today. We are here to help!

The Renters Rights Bill: Navigating the Changes with Michael Tuck Estate Agents

The private rented sector is undergoing a significant transformation with the introduction of the Renters Rights Bill. At Michael Tuck Estate & Letting Agents in Gloucester, we understand that these changes can be complex for landlords. This blog post aims to provide clarity and guidance on how to navigate the new landscape.

What is the Renters Rights Bill?

The Renters Rights Bill is a proposed piece of legislation designed to overhaul the private rented sector. Its primary goals are to provide greater security for tenants and improve housing standards. Key aspects include:

- Abolition of Section 21 ‘no-fault’ evictions: This is perhaps the most significant change. Currently, landlords can evict tenants without providing a reason using a Section 21 notice. The bill aims to remove this, offering tenants more security in their homes.

- Introduction of stronger grounds for possession: Landlords will still be able to regain possession of their properties, but only under specific, legitimate grounds, such as repeated rent arrears or anti-social behaviour.

- Lifetime deposits: The bill proposes a system where tenants’ deposits can be transferred between properties, reducing the financial burden of moving.

- Establishment of a new Ombudsman: A new private rented sector ombudsman will be created to resolve disputes between tenants and landlords quickly and efficiently.

- Introduction of a property portal: A new online portal will provide tenants with essential information about their rights and landlords’ responsibilities, as well as property information.

How Does This Affect Landlords in Gloucester?

The Renters Rights Bill will bring significant changes for landlords in Gloucester:

- Section 21 Evictions: The abolition of Section 21 evictions will require landlords to have legitimate grounds for possession.

- Property Standards: The focus on stronger grounds for possession and the new ombudsman will increase the importance of maintaining high property standards.

- Deposit Management: The proposed lifetime deposit system will require landlords to adapt their deposit management practices.

- Dispute Resolution: The new ombudsman will provide a faster and more efficient process for resolving disputes.

- Compliance: Landlords will need to ensure their practices comply with the new legislation.

How Michael Tuck Estate Agents Can Help

At Michael Tuck Estate & Letting Agents, we are committed to supporting landlords in navigating the changes brought about by the Renters Rights Bill. Our full management package can provide you with peace of mind and ensure compliance with the new legislation:

- Expert Guidance: Our experienced team will provide you with up-to-date information and guidance on the Renters Rights Bill.

- Property Management: We will handle all aspects of property management, including tenant vetting, rent collection, property maintenance, and compliance with the new legislation.

- Dispute Resolution: We will assist with any disputes or concerns, working towards a fair resolution for both landlords and tenants.

- Legal Compliance: We will ensure your property complies with all relevant regulations and legislation.

Choose Michael Tuck for Peace of Mind

The Renters Rights Bill brings a new era for the private rented sector. By choosing Michael Tuck Estate & Letting Agents’ full management package, you can ensure your property is managed effectively and in compliance with the new legislation.

Contact Michael Tuck Estate & Letting Agents today to learn more about our full management package and how we can help you navigate the Renters Rights Bill.

New Homes at Earls Park, Bristol Road, Gloucester

Our brand new 2 bedroom show home at Earls Park, Gloucester and Block J Apartments are now available to view!

Having achieved an unprecedented number of sales at the new homes development at Earls Park, Gloucester, Michael Tuck Land and New Homes are down to our last available one bedroom apartment and a only small number of 2 bedroom apartments for sale which will be available to view this weekend 8th and 9th March 2025.

Richard Tuck, Director of Michael Tuck New Homes said:

“We’ve been really impressed by the huge demand from purchasers at Earls Park. Matthew Homes build a traditional style house and we receive lots of positive feedback about how open and quiet the new development is compared with others in the area. The central public open space creates a real focal point for the new community and is within walking distance to Gloucester Quays along a stretch of canal.

What house types are available to reserve at Earls Park, Gloucester?

Please note that all of the images below are of similar house types and not of the specific plots that are currently available.

External finishes may differ from those shown below.

One and Two bedroom Apartments – Final Phase – from £160k – Available to view now!

Come and visit Block J for the first time this weekend with 5% deposit paid available on selected plots!

BRAND NEW ONE and TWO bedroom apartments at the Earls Park New Homes in Gloucester development. With an ALLOCATED PARKING SPACE the accommodation features an open plan kitchen/living area, two bedrooms, bathroom, en-suite shower, separate family bathroom and storage cupboards. Further benefits include gas fired central heating, UPVC double glazed windows, fitted kitchen including stainless steel oven, hob and extractor hood.

Bohon I – Three Bedroom Semi-Detached – £300,000 – ALL SOLD

‘The Bohon I’ is a 2 storey, 3 bedroom semi-detached property with 2 PARKING SPACES situated on the exclusive Earls Park development and walking distance to Gloucester Outlet Village based within Gloucester Docks. This superb family home comprises of a separate living room, a dining/kitchen room with soft close units, integrated washing machine/dryer, dishwasher and electric oven, gas hob & chimney hood. The first floor boasts a MASTER bedroom with en-suite along with two further bedroom and a family bathroom. Further benefits include gas central heating, 2 PARKING SPACES and NHBC warranty.

Bohon III – Three Bedroom Mid-Terrace – £299,000 – ALL SOLD!

The Bohon III is a stunning three bedroom traditional terraced house with parking and a garage. The accommodation comprises entrance hall and cloakroom, kitchen/dining room and living room with french doors to the south facing rear garden. The kitchen has soft close units and fitted with integrated washing machine/dryer, dishwasher, electric oven, gas hob and chimney hood. Three bedrooms and family bathroom on the first floor.

Mandeville – Three Bed End Terrace – £290,000 -ALL SOLD!

The Mandeville is a beautifully designed three bedroom traditional house boasting 991sqft of accommodation comprising entrance hall with cloakroom, kitchen/dining room and living room with french doors to the rear garden. The first floor has the master bedroom with en-suite shower, 2 further bedrooms and family bathroom. Further benefits include gas central heating, VINYL FLOORING TO THE KITCHEN, NHBC Warranty and 2 parking spaces.

last updated 5/3/25

How do I find out more about Earls Park?

The sales office at Earls Park is open 7 days a week between 10am and 5pm.

Please feel free to contact Harriet or Linda on 01452 522595 to arrange an appointment or for a quick chat.

Alternatively Michael Tuck New Homes in Gloucester are the sole selling agent and can be contacted on 01452 726443 or email newhomes@michaeltuck.co.uk

Goals for the Future: Michael Tuck Invests in Widden FC's Young Talent

Michael Tuck Estate & Letting Agents Proudly Sponsors Widden Football Club Under 7’s!

At Michael Tuck Estate & Letting Agents, we believe in supporting the vibrant communities we serve. We are thrilled to announce our sponsorship of Widden Football Club’s Under 7’s team!

This young and enthusiastic squad embodies the spirit of teamwork, dedication, and a love for the game. We are proud to support their development both on and off the field, providing them with the resources they need to succeed.

We encourage everyone to come out and cheer on the Under 7’s at their upcoming matches. Let’s show our support for these young athletes and celebrate the positive impact of youth sports within our community.

Go Widden FC Under 7’s!

De-cluttering Your Home: A Must-Do Before Putting it on the Market

So, you’re thinking of selling your home? Congratulations! Now’s the time to transform your living space into a showstopper that will attract potential buyers. One of the most crucial steps in this process is de-cluttering.

Why is De-cluttering So Important?

- Creates Space: A clutter-free home feels larger and more spacious. Potential buyers can easily envision themselves living in the space and imagine how their own belongings would fit.

- Highlights Features: By removing excess items, you allow the unique architectural features of your home to shine through. Buyers can better appreciate the natural light, high ceilings, and overall flow of the property.

- Creates a Sense of Calm: A clutter-free environment feels more peaceful and inviting. This creates a positive impression on potential buyers and makes them more likely to envision themselves living there.

- Increases Curb Appeal: A cluttered exterior can deter potential buyers before they even step inside.

Tips for Successful De-cluttering:

- Start Small: Don’t try to tackle the entire house at once. Begin with one room at a time and gradually work your way through.

- The 20/20 Rule: If replacing an item would cost less than £20 and take less than 20 minutes to find, consider discarding it.

- Donate or Sell: Donate unwanted items to charity or consider selling them online or at a local market.

- Declutter Digitally: Organise your digital files, delete unused apps, and unsubscribe from unwanted emails.

- Don’t Forget the Garden: Tidy up the garden, mow the lawn, and plant some colorful flowers to enhance curb appeal.

Staging Your Home:

Once you’ve decluttered, consider staging your home to make it even more appealing to potential buyers. This may involve rearranging furniture, adding some tasteful décor, and creating a warm and inviting atmosphere.

At Michael Tuck Estate Agents, we can also offer valuable advice on preparing your home for sale, including staging tips and decluttering strategies.

Contact us today to discuss your property and let us help you achieve the best possible selling price.

Simple home upgrades without breaking the bank

When you consider selling your home, you start to question your property’s value. We’re here to ensure you maximise your home’s value when placing it on the market. So, you want to know how to add value to your home without breaking the bank? Search no more. Here are 3 ways to add value to your home on a budget.

Freshen up your paintwork by decorating

A fresh coat of paint can work wonders when it comes to adding value. Whether it’s on the walls, creating a fresh blank canvas, or a vibrantly coloured front door, making it stand out in the market.

When trying to add value to a property, many individuals opt to upgrade the kitchen and bathrooms, but this can come at a costly expense. Decorate your bathrooms and kitchen by simply re-painting cupboards, creating an updated look at minimal cost and effort.

Increase your kerb appeal

First impressions of a property are a key part of attempting to grab potential buyers’ attention. Kerb appeal is when you create the look of an attractive, beautiful home before they’ve even stepped inside.

Having this increased kerb appeal allows the property to gain attention from all sorts of potential buyers. Add character and personality to a property with blooming flowers, a decorative doorknob, or a fancy letter box.

Upgrade your outdoor space

Mow the lawn, pick the weeds, tidy up the lawn edges, and create a look of care in your garden. This is one of the most cost-effective ways to add value to your home. If you have a garden or outdoor space, build an entire new room and extend your living space.

To create a beautiful effect, spruce up old outdoor furniture with a quick sand-down and paint with a wood stain. Place patterned cushions and cosy blankets on the outdoor furniture to create an inviting look.

Sell your home with Michael Tuck Estate & Letting Agents by your side

How to boost your home's value based on a budget!

The housing market has calmed down in the last year, which is helpful for buyers, who now have more choices. But if you’re hoping to sell, that means increased competition. Investing in your home to maximise its appeal could pay off, but what alterations are worth making, and what improvements can you even afford?

Let’s look at some changes that make sense for your budget.

- Up to £1000 : repaint tired walls and cabinet fronts with modern, neutral colours; upgrade fixtures and fittings; add soft furnishings; clean the carpets; and spruce up the garden.

- Up to £5000 : consider larger repainting jobs; replace cabinet doors; modernise the bathroom; or have walls professionally moved to create more space.

- Up to £50,000: Convert the loft and integrate it into the house; update the kitchen; install a home office/studio in the garden.

- Up to and above £250,000: Add substantially more living space, such as an annexe, detached garage, and outbuildings that can be rented out; convert the loft; add a functional extension, etc.

Of course, any structural changes may require planning permission or additional consents, especially if you live in a listed home or a Conservation Area. For one-to-one advice about improving your home’s value, talk to our team on 01452 612020 today.

Create beautiful borders to attract wildlife and buyers!

Climate change and shifting habitats are making it harder for our native species to thrive, but every garden – and border – can be a sanctuary for birds, bees, butterflies and insects. But what should you include in your borders to appeal to a variety of wildlife, and those potential buyers?

According to gardening experts, the following tips will ensure you capture the attention of visitors and residents alike. Let’s take a look.

- Introduce plants for pollinators, such as Verbena bonariensis and Geranium psilostemon, that suit a sunny position with well-drained soil.

- Add a statement salvia – Salvia nemorosa ‘Caradonna’ and drought-tolerant Salvia ‘Nachtvlinder’ are great choices.

- Include Umbellifers to draw in hoverflies and honeybees.

- Bring in the blues from plants like Michaelmas daisies, Geranium ‘Blue Cloud’ or Nepeta racemosa ‘Walker’s Low’, leaving seed heads intact over winter for food.

What better excuse for a trip to the garden centre than supporting British wildlife!

Four things that turn off buyers...

We all know that making a good impression on viewers is key to selling a property. On the other hand, every buyer is looking for different things, so how can you impress whoever steps through your front door?

According to buyer surveys, sellers should avoid:

- Grime and dirt – pay particular attention to tiles, grout, carpets and appliances when cleaning to leave a sparkling impression.

- Bad smells – cigarette smoke, stale air, food and pet odours can make your home feel oppressive. So, open windows regularly, install an air freshener plug-in and deep-clean furniture and carpets if necessary to eliminate old smells.

- Damp – mould patches or damp areas can signal a significant problem that could be expensive for a buyer to fix. Address the underlying causes before selling to avoid putting off your viewers.

- Seller-led viewings – no one knows your property like you, but viewers often feel uncomfortable being shown around by the owner. It’s harder to be honest and ask questions, which could make buyers feel awkward.

Of course, there are some things you can’t control. While one buyer may covet an immaculate showhome, someone else might jump at the chance to renovate. Likewise, some dream of a big garden, while others prefer a low-maintenance outdoor space.

That’s why a good estate agent is imperative; our experts carefully guide viewers to focus on how your home works for them.

Energy Bills: Are you paying more than the average?

While energy prices have thankfully begun to stabilise, many of us are still feeling the squeeze. But are you paying the same as other people in comparable households?

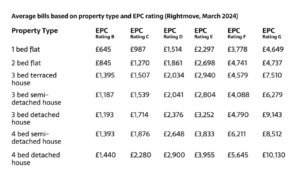

Based on an assessment of over 250,000 Energy Performance Certificates (EPCs) created between November 2023 and January 2024, Rightmove has tracked the average cost of energy bills across the country. The results show that the better your EPC rating (with A being the most energy efficient and G the least efficient), the less it’ll cost to run your home.

The average home has an EPC rating of D, leaving plenty of room for improvement. Rightmove’s analysis also showed that taking steps to increase your property’s EPC (by installing triple-glazing, upgrading your boiler, and insulating your loft) can even add £56,000 to its value.* Now, that’s worth thinking about.

For a free in-person valuation and advice about improving your EPC, contact us today.

*Data from the Rightmove Greener Homes Report 2023

Spring Into Action: Top Tips to Sell Your House this Season

Spring is finally here, and with it comes a surge in the housing market! As the days get longer and the flowers start to bloom, it’s the perfect time to put your house on the market and attract eager buyers. But before you open the doors for viewings, a little preparation can go a long way. Here at Michael Tuck Estate & Lettings, we want to help you get top dollar for your property. So, let’s dive into some top tips to get your house ready to sell this spring:

Boost Your Curb Appeal:

-

First Impressions Matter: You only get one shot to make a great first impression, and that starts with your home’s exterior. Give your front yard some TLC. Tidy up the flowerbeds, mow the lawn, and add a pop of color with some seasonal flowers. A fresh coat of paint on your front door can also make a big difference.

-

Let the Sunshine In: Wash your windows to allow natural light to flood your home. This will make your space feel brighter, more inviting, and showcase its best features.

Spring Cleaning Extravaganza:

-

Declutter and Depersonalize: It’s time to say goodbye to clutter! Pack away personal belongings and family photos. Potential buyers need to be able to envision themselves living in the space, and too much personality can be distracting.

-

Deep Clean from Top to Bottom: Spring is synonymous with cleaning, so give your house a thorough scrub. This includes everything from floors and windows to appliances and fixtures. A clean and fresh-smelling home is a major selling point.

Lighten Up and Stage the Space:

-

Embrace the Light: Open those curtains and blinds! Natural light is key to making your home feel spacious and airy. Consider rearranging furniture to maximize light flow.

-

Stage for Success: Strategic furniture placement and minimal décor can create a sense of spaciousness and flow. Potential buyers should be able to imagine their furniture fitting comfortably within the space.

Spring Scents and Touches:

-

Fresh is Best: Eliminate any lingering pet odors or cooking smells. Open windows to let in fresh air, and consider placing bowls of fresh fruit or fragrant flowers around the house.

-

Small Touches, Big Impact: Add a pop of color with fresh flowers or colorful throw pillows. These small touches can add a touch of spring cheer and personality without being overwhelming.

By following these tips, you can ensure your house shines this spring and stands out from the competition. Remember, at Michael Tuck Estate & Lettings, we’re here to help you every step of the way. Contact us today for a free valuation and expert advice on selling your property this season!

Top Spring gardening tips to revitalise your garden!

As the days lengthen and the temperature rises, it’s time to dust off your gardening tools. Here are some top tips to help you make the most of your spring gardening endeavours:

1. Prepare your soil before planting by removing any weeds, debris, or old plant material from your garden beds. Turn the soil over and incorporate compost or aged manure to boost fertility.

2. Consider the layout of your garden and plan what you want to grow, considering sunlight exposure, water availability, and the eventual size of your plants.

3. Start seeds indoors using trays and containers filled with a seed-starting mix to give them a head start and allow you to extend the growing season.

4. Prune and divide perennials by removing dead or damaged growth and cutting back overgrown branches. Dividing crowded perennials promotes better flowering.

5. Apply a layer of mulch to your garden beds to conserve moisture, suppress weeds, and regulate soil temperature.

6. Monitor for pests and diseases: Implement pest management strategies, such as hand-picking pests, using natural predators, or applying organic pesticides as needed.

7. Water deeply and infrequently to encourage deep root growth and drought tolerance.

By following these tips, you can kickstart the growing season and create a vibrant and flourishing garden to enjoy throughout the year.

8 home improvement tips for boosting the value of your home!

All homeowners want to achieve the best price for their home when they come to sell, so it makes sense to consider ways to increase its appeal before its market debut. Whether you’re looking for fast, budget-friendly options or can afford to spend more, you’re probably wondering what to focus on.

Here are 8 practical suggestions, along with the average percentage or amount of value increase based on recent industry data:

- Add a well-built conservatory or sunroom (5%)

- Update your kitchen or bathroom (10%) or consider more minor upgrades like replacing worktops or cabinet doors for a refreshed look

- Upgrade to a new boiler or central heating system (up to £8,000)

- Fix any damaged roofing to ensure structural integrity and insulation for a return on investment of up to 63%

- Invest in smart and energy-efficient upgrades such as smart lighting, LED bulbs, eco-friendly appliances, double glazing, and improved insulation (20%)

- Consider landscaping your garden and keep it well-maintained (20%)

- Redecorate with neutral tones to freshen up the interior and appeal to a wider range of buyers, adding around £2,000 to the value

- Install a garden office space (5-10%)